Course Curriculum

| UK Tax Accounting | |||

| Module 01: Introduction to Accounting | |||

| Introduction | 00:03:00 | ||

| First Transactions | 00:05:00 | ||

| T Accounts introduction | 00:03:00 | ||

| T-Accounts conclusion | 00:03:00 | ||

| Trial Balance | 00:02:00 | ||

| Income Statement | 00:03:00 | ||

| Balance Sheet | 00:03:00 | ||

| Module 02: Income Statement and Balance Sheet | |||

| Balance Sheet Variations | 00:03:00 | ||

| Accounts in practise | 00:05:00 | ||

| Balance Sheets what are they | 00:05:00 | ||

| Balance Sheet Level 2 | 00:03:00 | ||

| Income Statement Introduction | 00:06:00 | ||

| Are they Expenses or Assets | 00:03:00 | ||

| Accunting Jargon | 00:02:00 | ||

| Module 03: Tax System and Administration in the UK | |||

| Module 03: Tax System and Administration in the UK | 00:27:00 | ||

| Module 04: Tax on Individuals | |||

| Module 04: Tax on Individuals | 00:25:00 | ||

| Module 05: National Insurance | |||

| Module 05: National Insurance | 00:15:00 | ||

| Module 06: How to Submit a Self-Assessment Tax Return | |||

| Module 06: How to Submit a Self-Assessment Tax Return | 00:15:00 | ||

| Module 07: Fundamentals of Income Tax | |||

| Module 07: Fundamentals of Income Tax | 00:25:00 | ||

| Module 08: Payee, Payroll and Wages | |||

| Module 08: Payee, Payroll and Wages | 00:21:00 | ||

| Module 09: Value Added Tax | |||

| Module 09: Value Added Tax | 00:21:00 | ||

| Module 10: Corporation Tax | |||

| Module 10: Corporation Tax | 00:20:00 | ||

| Module 11: Double Entry Accounting | |||

| Module 11: Double Entry Accounting | 00:14:00 | ||

| Module 12: Career as a Tax Accountant in the UK | |||

| Module 12: Career as a Tax Accountant in the UK | 00:19:00 | ||

| Updated UK Financial Regulations | |||

| Module 1: UK Financial Markets and Regulatory Institutions | 00:18:00 | ||

| Module 2: Governance and Regulations by FCA and PRA | 00:21:00 | ||

| Module 3: Consumer Protection, Complaints and Redress | 00:14:00 | ||

| Module 4: Regulatory Governance and Conduct Standards | 00:17:00 | ||

| Module 5: Professional Integrity and Ethics | 00:18:00 | ||

| Module 6: Investment Principles | 00:19:00 | ||

| Module 7: Risk Management | 00:15:00 | ||

| Module 8: Taxation in Investments | 00:15:00 | ||

| Module 9: Investment Advice and Portfolio Management | 00:15:00 | ||

| Mock Exam | |||

| Mock Exam – UK Tax Accounting | 00:20:00 | ||

| Final Exam | |||

| Final Exam – UK Tax Accounting | 00:20:00 | ||

| Assignment | |||

| Assignment – UK Tax Accounting | 6 days, 10 hours | ||

| Recommended Materials | |||

| Workbook – UK Tax Accounting | 1 week, 2 days | ||

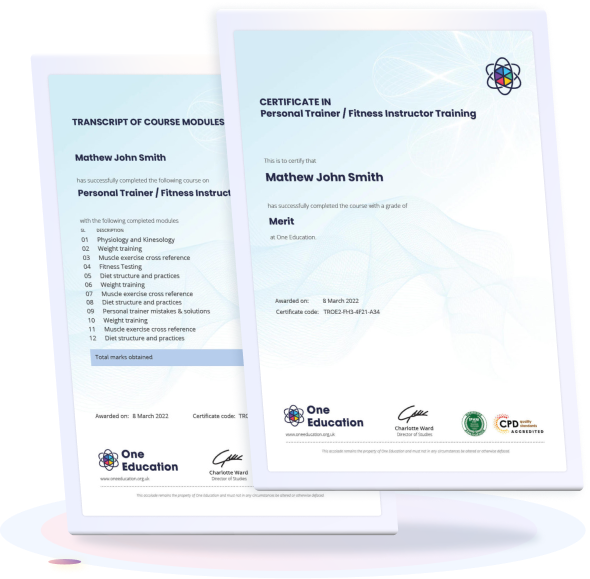

| Order your Accredited Certificate directly from CPDQS | |||

| Order your Accredited Certificate directly from CPDQS | 00:00:00 | ||

| Trustpilot Review | |||

| Trustpilot Review | 00:00:00 | ||

Take All courses for £49

Take All courses for £49

1 Year Access

1 Year Access

462 Students

462 Students  2 weeks, 2 days

2 weeks, 2 days