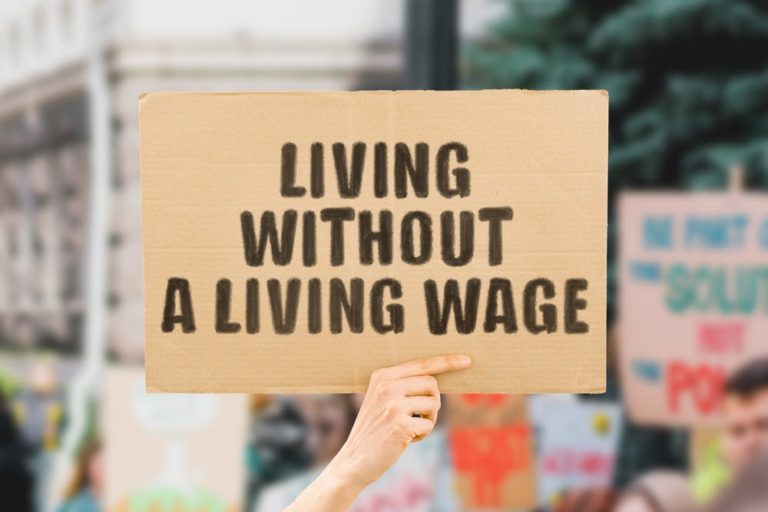

Getting paid as per National Minimum Wage and National Living Wage is your right. Find out what your National Minimum Wage and Living Wage should be depending on your age and type of work. Learn more about the Minimum Wage in the UK in 2021, including the following –

Table of Contents

What is the National Minimum Wage and National Living Wage?

The National Minimum Wage refers to the minimum pay per hour that almost all workers are entitled to. The national living wage is usually higher than the national minimum wage. Workers get it if they’re over 25. But from 1 April 2021, the national living wage will apply if workers are aged 23 and over. Moreover, the minimum wage a worker can get depends on their age. It also depends on whether they are an apprentice or not.

Who Gets the National Minimum Wage and Living Wage?

Workers must be at least school-leaving age to get the National Minimum Wage. However, school-leaving age varies depending on where a person lives. They must be 23 and over to get the National Living Wage starting from 1 April 2021.

It is important to note that contracts for any payment below the minimum wage are not legally binding. The workers are still entitled to the National Minimum Wage or the National Living Wage.

Any worker is also entitled to the correct minimum wage if he/she fits in any of the following:

- Part-time workers

- Casual labourers, for instance, someone hired for one day.

- Any offshore workers

- Foreign workers (workers from countries other than the UK)

- Agency workers (people who work in an agency)

- Any trainee or worker who is on probation

- Zero-hours workers (workers under zero-hours contract)

- Disabled workers (workers with special needs)

- Any worker who usually gets paid by the number of items they make (piece work)

- Homeworker

- Agricultural workers (people who work in the agricultural sector)

- Apprentices (conditions apply)

Who is Not Entitled to the Minimum Wage?

The following types of workers are not eligible for the National Minimum Wage or the National Living Wage:

- Self-employed people who run their own businesses.

- Company directors.

- Volunteers or voluntary workers.

- Workers on a government employment programme, like workers in the Work Programme.

- Members of the armed forces.

- Family members of the employer those living in the employer’s home.

- Non-family members who live in the employer’s home and share in the work but not charged for meals or accommodation; for instance, au pairs.

- Workers who are younger than school-leaving age, which is usually 16.

- Students of higher and further education, on work experience or a work placement up to one year.

- People who shadow others at work.

- Workers on any government pre-apprenticeships schemes.

- People on these European Union (EU) programmes – Leonardo da Vinci, Erasmus+ and Comenius.

- People who work on any Jobcentre Plus Work trial for up to 6 weeks.

- Prisoners.

- And people who live and work in a religious community.

Also, employers who offer internships should check if the person is entitled to the minimum wage. Often called work placements or work experience as well.

National Minimum Wage Rates and National Living Wage Rates in the UK in 2021

The following should answer your questions ‘How much is the national minimum wage in the UK in 2021?’ and ‘How much is the national living wage in the UK in 2021?’ The government announced the following rates for the year 2021.

The minimum wage and living wage rates before April 2021 are –

Age | Current rates |

25 and over | £8.72 |

21 to 24 | £8.20 |

18 to 20 | £6.45 |

Under 18 | £4.55 |

Apprentice* | £4.15 |

The minimum wage and living wage rates after April 2021 are as follows –

Age | Rates from April 2021 |

23 and over (NLW) | £8.91 |

21 to 22 | £8.36 |

18 to 20 | £6.56 |

Under 18 | £4.62 |

Apprentice* | £4.30 |

It is important to remember that no worker should get less than the national minimum wage or federal living wage. Also, the hourly rates change every April. For further information on national living and national minimum wage rates, you can check this link below.

Minimum Wage Rates for Apprentices:

As you have noticed, the rates are different for apprentices. It’s because the rules are not the same for other workers. Apprentices will be entitled to the apprentice rate if they’re either of the following:

- Aged under 19

- Aged 19 or over and in the first year of their apprenticeship

For example, an apprentice who is aged 22 and in the first year of their apprenticeship will get a minimum hourly rate of £4.15.

On the other hand, apprentices will be entitled to the minimum wage for their age if they are

- Aged 19 or over

- And have finished the first year of their apprenticeship.

For instance, an apprentice who is aged 22 and has finished the first year of their apprenticeship is entitled to a minimum hourly rate of £8.20.

Minimum Wage for Different Types of Work in the UK

The National Minimum Wage is primarily worked out at an hourly rate. However, it still applies to all eligible workers even if they don’t get paid by the hour. This means that regardless of how someone gets paid, they still need to work out their equivalent hourly rate. That is to see if they’re getting the minimum wage.

There are various ways of finding out that workers get the minimum wage. It depends on whether they are:

1. Paid by the hour

It is also known as ‘time work’. It refers to workers getting paid by the number of hours they are at work. For instance, people working in a call centre get paid for the number of hours they work each month.

2. Paid an annual salary

This is also known as ‘salaried hours’. A person is usually doing salaried hours work if all the following apply –

- The contract states how many hours they must work for their salary.

- Paid in equal and regular instalments through the year, for instance – getting paid monthly or every four weeks

- Not more than a month between each payment

- Don’t get paid more than once a week.

3. Paid by the piece

More commonly known as piece work. When workers get paid per task they perform or piece of work they do are categorised as doing ‘output work’. Their pay can be in either of the following –

- The minimum wage for every hour worked.

- A fair rate for each task or piece of work they do

However, output work can only be used in limited situations. Like when the employer does not know which hours the worker does. Examples of such a situation are – home workers.

4. Paid in other ways

This refers to unmeasured work. If the work is not coverable by any of the other work types, it’s ‘unmeasured work’. It includes getting paid a fixed amount to do a specific task. For example, being paid £400 to design a patio, regardless of how long it takes.

It is important to know what counts as working time to calculate the number of working hours. For all types of work, working hours include time spent on the following cases –

- At work and required to work.

- On-standby near the workplace (but do not include rest breaks).

- Not able to work because of a machine breakdown, but remained at the workplace.

- Waiting to collect goods or meeting someone for work.

- Travelling for work purpose, including travelling from one work assignment to another.

- Training or travelling for training purposes.

- At work and under specific work-related responsibilities.

How to Calculate National Minimum Wage and National Living Wage?

You can easily calculate how much the national minimum wage and living wage should be using the following directions –

For workers:

You can check online if you are getting the National Minimum Wage or the National Living Wage using a tool. You can check it by answering the following questions in this link- National Minimum Wage and Living Wage calculator for workers.

- How often do you get paid?

- How many hours do you work during the pay period?

- Does your employer provide you with accommodation?

- How much do you get paid before tax in the pay period?

- Does your employer take money from your pay for things you need for your job?

- Do you work additional time outside your shift?

- Does your employer pay you for any additional time you work outside your shift?

For employers:

Employers can use this National Minimum Wage and Living Wage calculator for employers. With this calculator, you can check if you’re paying a worker the National Minimum Wage.

You can also check the following using the online calculator:

- Whether you’re paying your workers the National Living Wage.

- Or you owe your employee payments from the previous year (in case you may have underpaid them in the period of April 2019 to March 2020)

The online calculator will let you know if you are paying the minimum wage based on answers to the below-mentioned questions –

1. Is the worker an apprentice?

2. How old is the worker?

3. How often do you pay the worker?

4. Do you provide accommodation?

5. How many hours does the worker work during the pay period?

6. How much do you pay the worker in the pay period?

7. Do you take money from your worker’s pay for the things they need for their job?

8. Does the worker work additional time outside their shift?

9. Do you pay the worker for the additional time they worked outside their shift?

As an employer, you need to stay ahead of others and take a proactive approach. This will ensure the well-being of both your business and your employees.

When Minimum Wage Increases are Paid?

Employees or workers will be entitled to a higher minimum wage rate in the following scenarios –

- When the government increases the rates (which is usually in April each year).

- When an employee or worker turns 18, 21,23 or 25.

- And when an apprentice turns 19 or if they finish their first year of current apprenticeship.

The higher rates will apply from the next pay reference period after the increase. This means someone might not get their increased payments straight away.

The pay reference period is the period of time the pay covers. For instance –

- The reference period is 1 day if paid daily.

- The reference period is 1 week if paid weekly.

- The reference period is 1 month if paid monthly.

However, the pay reference period cannot be longer than a month under any circumstances.

Pay Rights Helpline and Complaints

Suppose a person is entitled to the national minimum wage but not getting it. In that case, they can report it to HMRC (HM Revenue & Customs) for not paying the minimum wage. Anyone can report an employer to HMRC. A person can report it on behalf of someone. Initially, it can be an anonymous report.

If HMRC sees that an employer has not paid the minimum wage, they can send a notice and issue a penalty for not paying the minimum wage. HMRC can also take an employer to civil court for not paying the minimum wage or the living wage. The maximum fine for employers of non-payment is £20,000 per worker. The employers who fail to pay can be named publicly. They can also ban the employer from being a company director for up to 15 years.

If you are not getting the national minimum wage and think you should be, you can also contact Acas.

- You can use The Acas Helpline Online to ask any questions regarding your rates

- Find out about the kind of advice provided by Acas in A to Z of advice.

- Call the Acas helpline on 0300 123 1100 (Available on Monday to Friday, 8 am to 6 pm)

Acas can help employers, employees and their representatives by providing confidential and free advice. They give advice on employment rights, best practice and policies, and resolving workplace conflict as well.

Closing Notes

Minimum wages helps to protect workers against unduly low pay for their hard work. It also ensures a just and equitable share of progress for everyone. Thus making it essential for everyone to know what their correct minimum pay is and what actions to take if they are not getting paid enough.

Recent posts

- Mastering the Dissertation: A Comprehensive Guide to Academic Success

- Challenging Behaviour in the Classroom [Types & Solution]

- The Impact Of Remote Work On Women In The Marketing Industry

- Differentiating Web Design and Web Development

- Top 10 Social Media Management Tools for Businesses in 2024

- Why is Child Development so Important in Early Years

- Line Management: How to be a Good Line Manager?

- How Long Should a Health Sector Career Take?

- The Importance of BSL in Everyday Life

- Why Corporate eLearning is Essential for Organisational Training

April 20, 2021

April 20, 2021