Are you good with maths? Do you have a good grasp of recording and handling finance? What do you think about a career in something more like accounting, but which is not entirely accounting? Guess what, we have just the right thing that you will love to do. Bookkeeping! But wait, do you know what is bookkeeping?

Get to know A-Z of what is bookkeeping and kick-start your career as a bookkeeper by following through this content. We are going to explain to you what is bookkeeping with a series of questions.

Table of Contents

What is Bookkeeping?

Bookkeeping is a job that includes an organised and careful record of all kinds of financial transactions a business makes. Therefore, the bookkeeping activity includes documenting purchases, sales and all forms of expenses and income of a business.

Before, businesses used to keep a manually written book for all their transactions, but bookkeeping has shifted to electronic devices with development in technology. Although, many companies like to keep track of their money manually.

Firstly, bookkeeping is essential for all kinds of businesses, big, small, or non-profit organisations. Secondly, With the help of accurate bookkeeping, a company can keep track of all its financial transactions in its record book. Therefore, this process helps them to select investments, operate daily businesses and make financing decisions.

Furthermore, bookkeeping is an active part of the accounting process in a business. In a way, it is like the basics of accounting, which is necessary for every business.

While bookkeeping sticks to simply recording transactions and revenues and saving them on a general ledger, accounting is the broader process followed by bookkeeping. In contrast, accounting includes converting the bookkeeping information from the general ledger into financial business reports, metrics and much more.

Therefore, the bookkeeping occupation can help you to advance to the Accounting occupation easily. Bookkeeping can also be learned quickly, and anyone with a good grasp of numbers and recording can do it effortlessly.

What are the Types of Bookkeeping?

Learning ‘what is bookkeeping’ is incomplete without knowing what the types of bookkeeping are. Bookkeeping can be done through bookkeeping software like Xero, printed or manual book recording, or through Google Sheet and Excel.

Whether you are documenting the financial records manually or on electronic devices, a standard system is maintained to record, organise and present the data. As a result, there are actually two general methods of bookkeeping. These are Single-Entry Bookkeeping and Double Entry Bookkeeping.

Furthermore, you can easily learn bookkeeping by signing up for our course Bookkeeping and Accounting. It will help you to know everything about bookkeeping and give a qualification boost.

Single-Entry Bookkeeping

Single-Entry Bookkeeping is a simple accounting system that is used to record business transactions. There’s only one entry for each transaction in this system, and it goes either under incoming fund or outgoing fund.

All the transactions are recorded usually in a cash book or general ledger. The cash book is like a journal with columns drawn through the pages. The transaction details are organised in that column. For example, date, description of the transaction, and earned or spent.

Moreover, the single-entry bookkeeping system is suitable for businesses with minimum and not so complicated income and expenditure. A typical example of Single-Entry bookkeeping is given below for a bookshop.

| Date | Description | Income | Expense | Bank Balance |

| 1 May | Balance | £1000 | ||

| 6 May | Stock of 20 copies of Dracula | £40 | £960 | |

| 11 May | 4 copies of Pride and Prejudice | £20 | £980 | |

| 16 May | Notepad Sold 10 | £50 | £1030 | |

| 21 May | New Book Rack | £70 | £960 | |

| 26 May | Harry Potter book sold 15 | £75 | £1035 | |

| 31st May | 5 copies of Dracula | £25 | £1060 | |

| End Balance | £170 | £110 | £1060 |

Double-Entry Bookkeeping

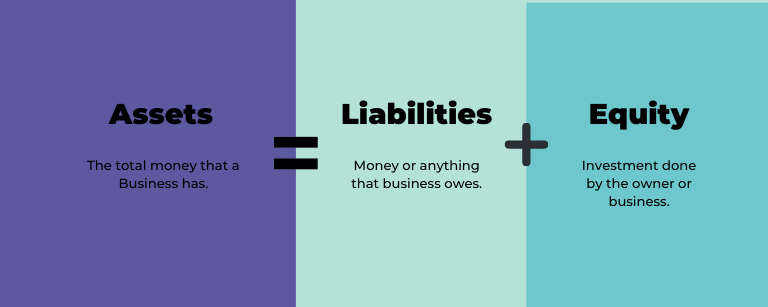

Double-entry bookkeeping is the basic concept of modern bookkeeping and accounting. Most importantly, it acts on the principle that states that every financial transaction has equal and opposite effects in at least two separate accounts.

Here in this system, financial transactions are recorded in the form of debits and credits. A debit in one account becomes a credit to another account. Therefore, the total sum of all the debits has to be equal to all the credits.

At the centre of this type of bookkeeping is recording what a business spends, which is known as debit, and what a business takes in that is known as credit.

Furthermore, double-entry bookkeeping helps standardly regulate the bookkeeping and accounting process. Plus, it also improves the accuracy of the recorded financial report and furthermore helps to improve error detection.

For example, in a week, your total bank balance is £5000. Your company has to pay property rent of £1000 that week. Here is how it is recorded.

| Account | Debit | Credit |

| Rent | £1000 | |

| Cash | £1000 |

In the same week, your company purchases some furniture for the office with £1000.

| Account | Debit | Credit |

| Furniture | £1000 | |

| Cash | £1000 |

On the other hand, your company earns £1000 from XYZ client.

| Account | Debit | Credit |

| Cash | £1000 | |

| XYZ | £1000 |

When you look at all three transactions, you can find that total credit and total debit are the same: they both add up to £3000.

What is the Importance of Bookkeeping?

In order to know what is bookkeeping and start a career as a bookkeeper, it is necessary to see the importance of bookkeeping. Bookkeeping is an essential part of maintaining business finance. Here are the major importance of bookkeeping for a company.

1. Bookkeeping keeps track of all the necessary financial documents, incomes and expenses are thoroughly recorded to pay corporate tax.

2. Only paying business tax and VAT is not enough; the business also has to maintain financial records so that HMRC can audit business finance at any time.

3. Bookkeeping is a major part of analysing and managing business finance. Most importantly, it oversees if the business has a healthy amount of cash flow to operate the business properly.

4. Bookkeeper analysis and reporting of business finance help to make business strategies and goals. Therefore, any kind of plan to invest, expand the business and even make a monthly budget of replenishing inventory needs bookkeeping support.

5. Lastly, bookkeeping reports help investors and sponsors to understand business and decide how reliable the business is.

Who are Bookkeepers?

The silliest answer to this is the person who is responsible for bookkeeping is called a bookkeeper. But to be more specific, a bookkeeper is the person who keeps track of all the financial flow that goes in and out of business. Companies need bookkeepers to run themselves like a well-oiled machine. Moreover, companies can keep an on-site or off-site bookkeeper, depending on their needs. The ongoing pandemic has increased the rate of cloud-based bookkeeping, according to a February report on bookkeeping.

Furthermore, the bookkeeper has to record and maintain all the money a business takes and gives. For example, purchases, expenses, sales revenue, invoices and payments. So, firstly, a bookkeeper needs to have a firm idea of their job, which is bookkeeping. Secondly, a bookkeeper has to record financial data into a general ledger. It is then used to make a balance sheet and income statement. Therefore, becoming a bookkeeper can be your first step in creating an accounting career.

Most of the time, the bookkeeper’s report goes to the business owner or the manager. Moreover, bookkeepers are involved in the strategy development of business. Furthermore, many bookkeepers also help with essential HR duties. For example, recording employee details on file, keeping track of payroll and long service leaves.

To become a successful bookkeeper, you need a 2 years degree program. But many companies hire people who have a high school degree or equivalent. Many companies also accept a GED.

Who is Hiring Bookkeepers?

All range of industry needs a bookkeeper. After all, if there is business, there must be cash flow. And there should be someone who is keeping track of the cash flow of a company. Some of the industry that frequently hires bookkeeper is listed below.

- Colleges and Universities

- Government Agencies

- Non-Profit Organisations

- Large or Small Companies

- Churches

- Healthcare Providers

- Lodging Facilities

- Retail Stores

When you start looking for a job as a bookkeeper, it is wise to check advertisements and job posting around your local area. In addition, you can open an account on LinkedIn to look for bookkeeping jobs in your area. You can also check out sites like Monster, Totaljobs and Institute of Certified Bookkeeper to search for bookkeeping jobs.

Why Should You Become a Bookkeeper?

So, why you should consider a bookkeeping career? Numbers, attention to detail, planning and organising plays a massive role in a Bookkeeping career. So if you are analytical and good with numbers, technology, organised, it can be an enjoyable job.

But a career in bookkeeping goes far beyond just your interest and skills. In fact, in a career in bookkeeping, you can expect solid growth, a good salary and many other beneficial and flexible entry requirements. In addition, a bookkeeping career is versatile as it has space for introverts, extroverts, and someone in-between. Though bookkeeping was there from the very beginning, it is recently that the job for bookkeeping started receiving acclimation.

Moreover, bookkeeping is one of the highest-paid jobs you can do remotely or online. Even more interesting, you only need a high school degree or equivalent to embark on a journey of bookkeeping. Therefore, bookkeeping can be your career line if you are great with logical thinking, financing, and good computer skills.

Here are some more important reasons for becoming a bookkeeper.

1. Lots of Opportunities.

There is a massive demand for bookkeepers. This is because economic growth and building a successful business for many people have called for an opening in a huge amount of bookkeeping jobs. Moreover, with enough qualifications, you can also do remote bookkeeping jobs.

Basically, every industry that deals with the regular exchange of money need bookkeepers. As a result, you can choose from a vast range of industries and select your favourite one to work with. You can either stick to the finance sector or even decide to become a part of the retail, healthcare or insurance sector.

2. Technologically Advanced Career

Bookkeeping can be done manually, but technology makes it easier for bookkeepers to do the job. As a matter of fact, businesses always need bookkeepers to maintain financial records and ensure they are done accurately.

Though it can be done manually, tracking and keeping financial records is more manageable and becomes more error-free with technology. In addition, with the help of new software and technology, businesses have to deal with fewer paper checks due to bookkeeping software programs and the evolution of e-banking.

3. Gives you Working Flexibility

You can be a freelance bookkeeper. The career gives you the flexibility to work from home. You can choose to become a full-time or part-time bookkeeper for an established business, or you can also do freelance. Once you have enough qualifications or had specific progression in a bookkeeping job, you can progress further to different branches from accounting to auditing. Moreover, you can also start your own business and become your own boss.

4. You will be Up-to-Date with Your Skills

Bookkeeping is a dynamic career, and changes take place all the time. Therefore, it will compel you to develop the necessary skills to stay updated and do the job effortlessly. It also helps you to gain updated knowledge of your industry and beyond. In addition, you have to keep to date with the latest bookkeeping software like Xero and QuickBooks. This will help to make your work swifter.

If you are keen to learn more about bookkeeping software, these courses on Xero and QuickBooks will help you to do so. These courses will help you advance your career. Additionally, it will give you a professional certification that can be used in the UK and internationally.

5. You do not have to be a University Graduate.

Bookkeeping can be a fantastic opportunity for people who do not want to further their education level to the university level. It is also an excellent option for those who want to change their career. In addition, you qualify yourself on your own terms by taking qualification courses. You will get to know more about this in a while.

What are the Responsibilities, Skills & Salary of a Bookkeeper?

As a bookkeeper, you will have some essential roles to play for the company and show significant bookkeeping related skills. The responsibilities and skills required may vary from company to company, but it is necessary to prepare for it all to get the upper hand.

Responsibilities of a Bookkeeper

Here is some day to day responsibilities of a bookkeeper:

1. Balancing accounts or doing double bookkeeping.

2. Processing and maintaining sales invoices, receipts and payments.

3. Editing and writing budgets

4. Completing VAT returns

5. Making invoices for the inland revenue

6. Checking and analysing company bank statements

7. Preparing cash flow statements

8. Alerting their client to any financial discrepancies

9. Dealing and organising financial paperwork and filing.

10. Make annual profit and loss statements.

If you work for a big organisation you may have to work as part of a team and as a result, you can share the workload with each other. But in smaller organisations, you may have to work alone and be responsible for all bookkeeping duties. You may also have to handle the payroll duties.

Skills

Altogether, as a bookkeeper, you must master a variety of skills. There are several skills that you require to perform bookkeeping precisely and efficiently. Below are some of these essential skills:

1. Numeracy Skills

In order to be a bookkeeper, you have to be very good with numbers. You need to be able to handle all the numbers with ease. Therefore, your arithmetic skills should be more than elementary level. Moreover, you have to do big calculations swiftly as it will be routine in a bookkeeping job.

2. Organisational Skills

As a bookkeeper, you have to be highly organised. Through organisation skills, you will be able to stay focused and prioritise important tasks. You will also be able to use your time, energy, strength, mental capacity and physical space more effectively.

Moreover, you will have to deal with a lot of data. Thus, sorting data and files in order has to be something you do with ease. A co-worker may have many queries from you, and you have to answer, which can be impossible without being organised.

3. Communication Skills

Though you might think bookkeeping is all about calculations, making reports, and analysing, you also need to have communicative skills. Specifically, you need to collect financial data from all over the office by speaking to other employees.

4. Tech Skills

You need to be updated with all the latest technology related to bookkeeping. For example, Qr code scanner, electronic banking, operating a computer efficiently- is a regular part of bookkeeping job.

On the other hand, you need to be good with bookkeeping software. Basically, you must know how to operate basic Microsoft Office applications, Google Docs, and accounting software. In addition, skills in Microsoft Excel, Zero and QuickBooks will help you a lot with bookkeeping. Furthermore, if you are doing cloud-based bookkeeping, being tech-savvy can be life-saving.

5. Time Management Skills

One more important skill that you must have to be a bookkeeper is time management skills. This is because any other abilities can go in vain if you do not have the proper time management skills. It requires doing the necessary task at the right time and submit or prepare records and data ahead of time.

That is why it is essential you know how to make a list of your priorities, deadlines, or other activities that must be done before a designated time. You need to deal with many tasks and people daily, so having time management skills will boost your productivity.

Other Necessary Skills that you should have for a bookkeeping job are:

1. Data Entry

2. Integrity and Transparency

3. Problem-Solving

4. Attention to Details

5. Decision-Making

Average Salary of Bookkeepers

The average salary for bookkeepers around the UK is £27,000 a year. As a starter, the salary is £18000 per year and goes up to £35,000 a year for experienced. Bookkeepers usually have to work around 37-39 hours per week. The job is typically from 9 am to 5 pm. Therefore, it will help balance your personal and work life.

There are opportunities for a part-time job and also job sharing. Furthermore, some companies also hire temporary bookkeepers. Therefore, the bigger company you work for, the better your scope for developing a promising career in bookkeeping.

Here are some important data of bookkeeping job.

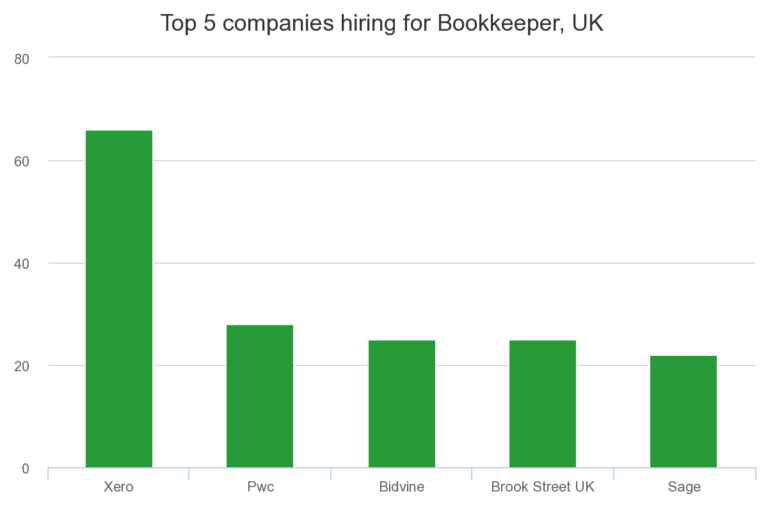

- The number of ads for bookkeeping jobs is 289.4% higher than last year.

- Most of the bookkeeping job ads are for accounting & finance jobs and part-time jobs.

- The top companies hiring for Bookkeeper roles are Xero, PWC and Bidvine.

Source: Adzuna- Bookkeeper salary stats

How to Start a Career as a Bookkeeper?

Learning what is bookkeeping can be pointless without knowing how to start a bookkeeping career. Though it is not necessary to complete a college degree, some employers prefer candidates who have done some college course or have some kind of credential to prove their bookkeeping skills.

You can get into this job through:

- A college course

- An apprenticeship

- Working towards this role

- Applying directly

Hence, there are necessary steps you can take to become a successful bookkeeper. Let us start from the beginning.

1. Pursue a High School Degree

In order to become a bookkeeper, it is essential to have a high school degree, diploma or GED. It is the most basic need for this job. This is because, by having a high school degree, you will have basic mathematics, writing, and communication skills. These skills are essential for bookkeepers. However, other essential skills that come from high school are time management, organisation, and teamwork.

Moreover, during high school years, you can take major subjects related to accounting and finance. Additionally, along with required coursework, take electives where possible. For example, take any kind of classes related to accounting, personal finance and business management.

You can also earn a level 2 college courses certificate in Bookkeeping, accounting, Manual and Computerised Bookkeeping. In the UK, you may need 2 or more GCSEs at grades 9 to 3 (A* to D), or equivalent, for a level 2 course.

2. Train Yourself

If you are already a high school graduate and looking for job opportunities, you can easily choose a bookkeeping job. As a matter of fact, you can self-train yourself at any stage from various sources. Most of the time, many bookkeepers start training themselves by taking a Professional bookkeeping course. Or you can train yourself by taking specific skills and software courses. With the help of online courses, you can teach yourself the art of bookkeeping, and the certificate will also help you get a job.

Often self-taught bookkeepers learn the skills without any direct professional training. But once you get a bookkeeping job, you will have lots of growth opportunities. Moreover, many companies take in candidates with basic bookkeeping skills and train them over time with all kinds of necessary bookkeeping responsibilities. A lot of companies train their entry-level bookkeeper within 6 months or more. Then, they provide plans, courses and personal development plans for their employee’s growth.

The time needed for self-taught bookkeepers to achieve the required skills varies depending on their dedication, chosen method, and personal schedule. However, many aspiring bookkeepers do an internship with a reliable company and achieve training. This can be very beneficial because the company hires you as a permanent bookkeeper if you do good. You can find internships through your school, personal network or searching online.

3. Apply for Bookkeeping Positions

You can apply for a bookkeeping position in a variety of ways. Many aspiring bookkeepers do an internship with a reliable company and achieve training.

If you want to go for a paid job, there are also plenty of options for you. But the first thing you need to do is make a well-written resume. You have to highlight all your bookkeeping related qualities in the resume and also make it well-structured.

If you have any earlier experience, you need to highlight them along with your educational background. Knowledge and experience in accounting software, understanding of financial statements, personal as well as business, and your willingness to learn and grow are excellent skills to include in your resume. If you do not have enough technical skills related to the role, you can highlight your interpersonal skills such as multitasking and time management in your resume.

Make sure you design your resume in a way that represents the position you are applying for. Go through the job description, add any relevant keywords to your resume to get noticed.

4. Become Freelance Bookkeeper

On the other hand, if you want to become a freelance bookkeeper, there are immense amounts of opportunities worldwide. Therefore, your next step will be to establish your own bookkeeping service. The company or clients you want to sell your services to will look for reliable freelance bookkeepers with practical experience. As a result, you might have to do a traditional on-site bookkeeping job for at least two years.

Furthermore, you must show some experience, skills and knowledge for starting freelance bookkeeping. You can go search for a freelance bookkeeping job locally, remotely, and also virtually. You have to also make sure that you have a unique, authentic, and catchy profile that will gain clients’ attention. This profile will also give details about your capabilities as a bookkeeper.

Furthermore, you can have your official website or social media account to represent yourself as a bookkeeper and advertise yourself online. One more essential thing is making yourself an industry-specific bookkeeper. Therefore, if you have particular experience in bookkeeping for schools, businesses, charities or government organisations, make it clear on the website or in a professional profile. Rather than targeting everything at once, specify an industry you would prefer to work with.

5. Consider Certification and Further Education

You can never stop learning; it is also true for a bookkeeping career. Whether you are an on-site professional bookkeeper or freelancer bookkeeper, you can consider taking a certification. Most importantly, you have to focus on your personal and educational growth to be successful in your bookkeeping career. Moreover, acquiring a bookkeeping certification will help you become and look more professional and authentic.

You can be a licenced bookkeeper through ICB, Institute of Certified Bookkeepers as well. Firstly, the Institute of Certified Bookkeepers is the world’s largest bookkeeping organisation. Secondly, it develops and sustains the professional standards of bookkeeping by establishing applicable qualifications and awarding membership grades that recognise academic achievement, employment experience, and competence.

Another key point is you must abide by bookkeeping laws. A money-laundering licence is a legal requirement for bookkeepers in the UK. Therefore, all bookkeepers must have this licence. This is because, according to the Money Laundering Regulations 2017, if you are a bookkeeper who runs your own business and provides a service to clients, you must have a supervisory body (MLR). Through the Practice Licence scheme, ICB members are monitored.

Have A Great Bookkeeping Career!

Whether you are still contemplating becoming a bookkeeper or midway through it, know that a bookkeeping career can be exciting, rewarding, and one with a high reputation. With a bit of effort on your part, you can become an established bookkeeper. If you want to know more about what is bookkeeping and gain professional skills in bookkeeping, join our course Xero Accounting and Bookkeeping Online.

Read more

- Challenging Behaviour in the Classroom [Types & Solution]

- The Impact Of Remote Work On Women In The Marketing Industry

- Differentiating Web Design and Web Development

- Top 10 Social Media Management Tools for Businesses in 2024

- Why is Child Development so Important in Early Years

- Line Management: How to be a Good Line Manager?

- How Long Should a Health Sector Career Take?

- The Importance of BSL in Everyday Life

- Why Corporate eLearning is Essential for Organisational Training

- Take your Business Expertise to the next level: Get your MBA

January 06, 2024

January 06, 2024