Words can not describe how hard it is to lose a loved one. But unfortunately, the world doesn’t stop for anyone. In addition to dealing with the loss of a loved one, we have to manage their assets and liabilities too. And ‘what is probate’ is a common question for people dealing with the financial affairs of someone who has died.

Keep reading to find out what is probate, when do you need it, how to get probate etc. Get answers to all your questions about probate – with and without a Will.

Table of Contents

What is Probate?

Probate refers to the legal right to deal with someone’s property, money and other possessions, such as their estate, when they die. Probate gives the right to retitle or transfer property, money, or possessions to beneficiaries of the will.

What does probate mean? The word ‘Probate’ comes from the Latin word ‘probare’, which means to test or prove. Therefore, probate means proving that the Will is valid. Probate is the common term for a legal process in which a will is reviewed to determine its validity and authenticity. It is also referred to as the general administering of a person’s will or a person’s estate without a will after they are dead.

To define probate or explain probate simply, it refers to the legal process of reviewing the assets of a deceased person and determining the inheritors.

What is the Purpose of Probate?

The purpose of probate is to legally administer someone’s estate after they die. And probate proves that the will of a deceased person is valid and authentic. So, you must not make any financial plans or put the property on the market until you get probate.

What is a Grant of Probate?

Grant of Probate is a particular grant of representation that is obtained from the court. A grant of probate confirms the legal authority given to an executor of a deceased person’s will to administer a deceased’s estate.

And this grant allows the executor to handle the assets in a deceased’s estate. For instance, close their bank accounts, sell their property, and pay the debts and expenses of the administration of their estate. In essence, the grant proves the validity of the will.

Who requires a Grant of Probate?

Usually, the next of kin (administrator) or executor anointed in the will requires a grant of probate to claim, transfer, sell or distribute any of the deceased’s assets.

When do You Need Probate?

When dealing with a deceased person’s property, money or any other possessions, you will need confirmation that you have the right to do so. For example, banks, building societies, or insurance companies often ask for probate before releasing any money and other property belonging to the deceased.

What triggers probate in the UK?

Generally, probate is needed in England or Wales if the deceased person owned property or significant assets in their sole name. If they owned assets with a value of more than £5,000, then you will need to apply for probate.

How to Check if Probate is Needed?

You can contact the deceased person’s financial organisations to check if you need to get probate. For instance, reach out to their bank or mortgage company to find out if you’ll need probate to have access to the assets.

Since every organisation has its own rules, it’s wise to check with them beforehand.

When do You Not Need Probate?

As mentioned earlier, probate is needed when the deceased person owns significant assets. So, if they had property or assets of low value, probate would not be required. Usually, some assets up to a value of £5,000 can be transferred without going through the probate process. However, financial institutions each set their own limits for probate.

In what circumstances, probate is not required? You might not need probate if the deceased person –

That’s because the jointly owned assets will automatically pass to the surviving owners. For example, it can be property, bank accounts, or life policies that continue in the survivor’s name.

Also, probate might not be required if the Estate is insolvent. That means it does not have enough assets to pay off its debts.

What Happens When Probate is Not Needed?

Sometimes financial institutions such as banks do not require you to have a grant of probate to access the deceased’s assets. But they will still want to see a copy of the death certificate and your proof of identity before giving you access to the accounts and releasing the funds.

What does Probate Involve if There’s a Will?

If there is a will, and you’re named as an executor in either the will or an update to it, also known as a ‘codicil,’ you can apply for probate. Normally, you’ll be told if you’re an executor beforehand. Also, you’ll inherit assets only if you’re named as a beneficiary in the will.

But what if you don’t want to be an executor?

Well, if you don’t want to be an executor, you have the right to step away from the role. In fact, you have three options in such a scenario,

In case, more than one executor is named in the will, you can choose not to apply now. Instead, reserve the right to apply later by communicating this to the person who’s making the probate application. If you’re holding power reserved, you need to do this in writing.

What does Probate Involve if There’s No Will?

If there is no Will, you may have to apply to the Court for a Grant of Representation to administer the Estate. Then the Estate is distributed as per the rules of Intestacy (the term used for dying without leaving a Will).

The Rules of Intestacy

When a person dies without leaving a Will, or if the Will is not valid, their property or estate must be administered as per the Rules of Intestacy.

When someone dies without leaving a Will, it’s called ‘dying intestate’. It basically means that the assets they leave behind will be distributed as per law since they didn’t leave any valid, legal instruction, i.e., a Will. They are also applicable when there’s a Will, but it’s invalid. Similarly, there can be a partial intestacy – where there’s a Will, but a beneficiary has died, and the Will does not state who is to receive a part of the estate.

The rules of intestacy define who is entitled to a share of the estate and who is to be appointed to administer its distribution. The rules may vary slightly depending on where the deceased lived – England and Wales, Scotland or Northern Ireland.

Who Inherits if Someone Dies Without a Will?

The law decides who inherits the estate if there is no Will. For instance, a surviving partner who wasn’t married or in a civil partnership with the deceased has no automatic right to inherit. Nonetheless, you can use this tool to determine who will inherit if there is no Will as per the rules of Intestacy. The following can inherit the estate in order of relationships.

- Living husband, wife or civil partner

- Children, grandchildren or direct descendent of the deceased’s. (Children include legally-adopted sons or daughters, but not stepchildren).

- Living parents

- Brothers or sisters

- Living grandparents

- Aunts or uncles

To summarise, the estate goes to their legal partner, the next of kin or the person closest in blood relationship to the deceased in the family tree. If there are no living family or blood relatives of the deceased’s, the whole estate goes to the Crown. However, an entitled relative or adopted person of the family can claim the estate.

How to Get Probate?

You need to apply to get probate. The entire probate process has been broken down to help you understand how to get probate and which steps you’ll need to complete.

- 1. Find the Original Will (if there is one)

- 2. Verify Who can Apply for Probate

- 3. Get the Death Certificate

- 4. Identify the Deceased’s Assets and Debts

- 5. Estimate the Estate’s Value and Pay Inheritance Tax

- 6. Report the Estate’s Value

- 7. Apply for Probate

1. Find the Original Will

This is applicable if the deceased left a valid will. First, you’ll need to locate the original Will. That’s because you’ll have to send the original will with your probate application. And you cannot send a photocopy. The original document will be kept in the probate registry, and it’ll be a public record.

The original will and any updates can be kept at the house, with a probate practitioner or at the national probate registry in Newcastle. But if it’s in the probate registry, you’ll need to provide the death certificate and evidence you’re the executor.

In case, there’s more than one will, only the most recent will is valid. However, you should not get rid of any copies of earlier wills until you’ve received probate.

You can get help from a probate practitioner, such as a solicitor, if you cannot understand a will.

If you cannot find the original will, you’ll need to fill in Form PA13 and Report a will is lost to support a probate application.

2. Verify Who can Apply for Probate

Only certain people can apply for probate. Who can apply depends on whether there’s a will. To clarify,

- If there’s a will, executors, or PR’s named in it can apply

- If there’s no will, the closest living relative can apply (who is called the administrator for the purposes of probate).

Executors or PR’s are the people who are appointed in a Will and entitled to deal with a deceased person’s estate.

This also answers ‘who needs probate?’ So, if you are named in someone’s will as an executor or the closest living relative of the deceased’s, you may have to apply for probate. However, you do not always need probate to deal with the estate.

3. Get the Death Certificate

To apply for the probate, you’ll need the death certificate or an interim death certificate from the coroner. You have to register the death, and then you can order the certificate online, by phone or by post.

4. Identify the Deceased’s Assets and Debts

You have to determine the deceased person’s assets and debts such as savings, investments, mortgages, and loans. You can contact the applicable organisations, such as banks or other utility providers, and inquire about the person’s assets and debts.

5. Estimate the Estate’s Value and Pay Inheritance Tax

You’ll need to estimate the value of the deceased’s estate as part of your probate application. And then find out if you’re required to pay Inheritance Tax. However, most estates are not taxed.

How long it takes to value an estate depends on how big or complicated it is. In fact, valuing an estate can take up to several months. Or even longer if it involves trusts or there’s tax to pay. As part of the application, you must show that – either you have paid any Inheritance Tax due, or there is no Inheritance Tax to pay.

There will be deadlines if the estate owes Inheritance Tax. For example, you’ll have to start paying tax by the end of the sixth month after the person dies and send Inheritance Tax forms within one year. However, you can make a payment before you finish valuing the estate.

6. Report the Estate’s Value

Afterwards, you’ll need to report the estate’s value. How you report the value depends on whether there’s Inheritance Tax to pay and when the person died. It will vary depending on whether they died before 1 January 2022 or after 1 January 2022 and the estate is an excepted estate.

7. Apply for Probate

Then you can apply to the Probate Registry for the grant of representation. This document confirms who has the legal authority to administer the estate. If there’s Inheritance Tax to pay, you have to wait 20 working days after sending the tax forms to the HM Revenue and Customs (HMRC) before applying for probate.

You can apply for probate online or by post. But, due to COVID-19, probate applications are taking up to 8 weeks to process. And the processing time is longer for paper applications than online applications.

After you’ve completed all the previous steps, you can apply for probate by creating an account with your email ID. You can use this tool to check if you have everything you need for the application.

Post-Grant Estate Administration

In other words, ‘what happens after probate is granted?’ After probate is granted by the Probate Registry and the grant of representation has been issued, the executor has the authority to call in the deceased’s assets. Post-grant estate administration includes the following –

Settle Liabilities and Pay Taxes

First of all, the debts have to be paid off before distributing any specific legacies (i.e., certain gift items, such as paintings or jewellery) and pay the pecuniary legacies (cash gifts) if they are included in the Will. This might also involve liquidating (or selling) the deceased’s assets to settle any liabilities. Then pay final estate administration expenses and any further Inheritance Tax to HMRC, Income Tax or any Capital Gains Tax due to or from the estate.

Maintain Estate Accounts

It is required to prepare estate accounts for all payments made in the estate and show the balance remaining for allocation to the beneficiaries. Then the estate accounts are to be sent to the personal representatives (such as the executor in the Will) for approval.

Estate accounts include money received, assets transferred to beneficiaries and amounts paid out of the estate. Also, these accounts confirm each beneficiary’s entitlement (as per the deceased’s Will or the intestacy rules. Moreover, they indicate whether an interim distribution (part payment of the beneficiary’s share) can be made at an early stage before the tax position is resolved.

Transfer Assets to the Beneficiaries

Before finalising the estate, it is essential to complete estate tax returns report any income and capital gains made during the administration period.

So after these are resolved, and provided there are no challenges to the estate or any complicating factors to prevent distribution, assets can be transferred to the beneficiaries. It can include distributing cash (after collecting & selling estate assets) or transferring the ownership directly to the beneficiaries.

Again, transferring and distributing assets to the beneficiaries will be done as per the terms of the Will or the rules of intestacy.

How Much Does Probate Cost?

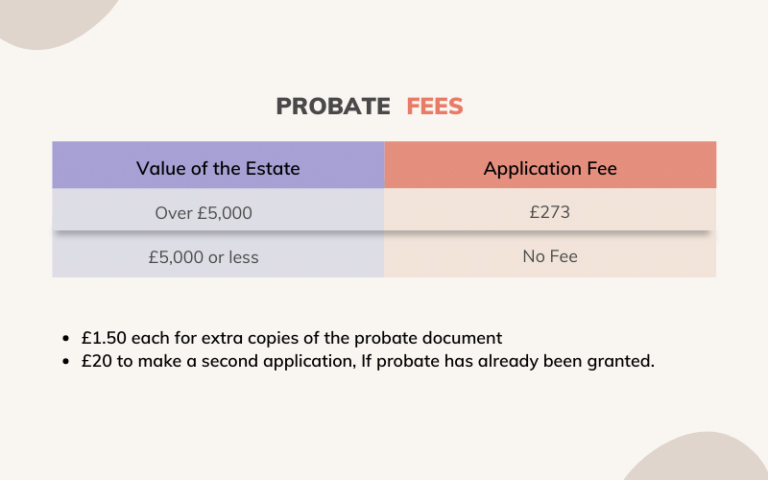

You may have to pay a fee when you apply for probate. Whether you’ll need to pay a fee depends on the estate’s value.

- If the estate’s value is over £5,000, the application fee is £273.

- There’s no fee if the estate is £5,000 or less.

If you need extra copies of the probate document, you can order them for £1.50 each. And it’ll cost £20 to make a second application after the probate has already been granted. So, for instance, if you previously held ‘power reserved’ on the first application, and now you want to apply for probate. Then you’ll have to pay the fee, even if the estate’s value is £5,000 or less.

Also, you can get help with the probate fee and other court fees if you require. This is applicable if you have a low income or are entitled to certain benefits.

How Much Does Probate Cost Through a Solicitor?

Probate services can be provided by a solicitor, probate specialist or a bank. So, probate and estate administration fees can vary widely depending on who does it. For example, some probate specialists and solicitors may charge an hourly rate. On the other hand, some will charge a fee that’s a percentage of the estate’s value.

How much do probate services cost? Usually, it will cost between 2.5% to 5% of the estate’s value for their work and services.

A few probate specialist companies also charge a fixed fee for their services. It can be an estimate of the volume of work involved. And some of these companies claim to be cheaper than a traditional solicitor or accountant. Moreover, some banks will offer probate and estate administration services. But, these services are comparatively more expensive than a solicitor or a specialist company.

So, remember to compare quotes before choosing a probate specialist. Besides, you can use competing quotes to negotiate a cheaper fee for your services.

Frequently Asked Questions About Probate

The question ‘What is probate’ is followed by many other questions such as the following.

What is the Probate Threshold?

The probate threshold refers to the value of an estate below which probate may not be required. It’s the amount at which the assets of a deceased person can be distributed without legal proceedings. This threshold varies depending on the jurisdiction. For instance, in the UK, the current threshold for probate is £5,000.

What Does Probate Mean UK?

Probate in the UK refers to the legal process of dealing with someone’s estate after they’ve passed away. This involves handling their assets, debts, and distributing inheritance according to their will or the law if there’s no will. It ensures that the deceased person’s wishes are followed and their affairs are settled properly.

Do I Need Probate if There is a Will?

If you are named in someone’s Will as an executor, you may need to apply for probate. Probate gives you the authority to administer the estate of the person who has died according to the instructions in the will. Check out the previous section named ‘ when do you need probate’ for more information.

What is the Threshold for Probate in the UK?

In case you’re wondering, how much money can someone leave before probate is required? There is no established threshold in England and Wales. Therefore, the probate threshold can be anywhere between £5,000 and £50,000. Usually, the probate threshold will depend on the bank or financial service. That’s because every organisation has its own rules on how much money it can release without a grant of probate.

Do I Need to Pay Inheritance Tax When Probate is Not Required?

You might still need to pay inheritance tax to HMRC on estates, even if you don’t need a grant of probate. Regardless, cases where probate is not needed often overlap with cases where inheritance tax is not required. For instance, when the estate and assets pass directly to a spouse or the estate’s value is low.

Still, you should know, ‘what is the Inheritance Tax threshold?’ The Inheritance Tax threshold in the UK for 2022 is £325,000. It indicates that anything over £325,000 will be taxed at 40%.

If There’s More Than One Executor, Who Should Apply for Probate?

If there’s more than one executor named in the Will, all executors must agree on who makes the application for probate. Also, up to 4 executors can be named on the application.

Suppose you find that the Will in which you are named as an Executor needs Probate, you can decide between you and the other Executors who would apply for probate. You can complete the probate yourselves, or you can hire someone to manage the process for you.

Can I do Probate Myself?

You can apply for probate yourself. And this can be cheaper than paying a probate practitioner to apply for you. But probate can be a lengthy process, with a significant amount of paperwork to collect, complete and process. And this can cause a significant amount of stress and worry.

However, if you have any confusion or have trouble understanding a Will, it’s wise to contact a professional. Or, if the Estate is insolvent, you should consider asking a Probate specialist to manage this process for you. That’s because when dealing with an insolvent estate, it could expose you to personal liability for any mistakes made.

How Long do I have to File Probate After Death?

Probate can be applied for after 7 days of the death of the testator. Sorting out an estate without a Will usually take more time. That means the sooner you apply for probate, the sooner you can transfer the estate to the beneficiary.

How Long Does the Probate Process Take?

The entire process of Probate of a Will can take at least six to twelve months to complete. And the average length of time it takes to complete the process is 9 months.

How long after probate is granted does it take to receive the inheritance? If it’s a straightforward estate with no property to sell, and only has a single bank account, it might take as little as 3 months.

What Happens if the Executor is Unable to Apply for Probate?

If an executor is unable to apply, for instance – if an executor has died, the other executors can apply in their place. Or, if an executor has a severe health condition or mental impairment, they cannot apply. Hence, they can get a medical professional (such as a doctor) to fill in the form for a Medical certificate (for probate).

Are there Legal Consequences if I Make Mistakes as the Executor?

Yes, you might face both legal and financial repercussions if you make any error as an executor. This holds true even if the mistake is accidental. For instance, if you under-calculate how much Inheritance Tax needs to be paid, you can be held liable for this. Alternatively, if you over-calculate Inheritance Tax, you risk the estate paying more to HMRC than is needed. So, it might be wise to consult a specialist if the estate is considerably large and complex.

Do I Need Probate if I have Power of Attorney?

Understandably, a person who is trusted to deal with someone’s affairs during their lifetime can be trusted to do the same after their death. And while this is common for the same person who had a power of attorney to be the executor or administrator of the estate, you still may need probate.

Power of attorney gives you authority to deal with events that happen while your loved one is alive. However, power of attorney will no longer be valid when they die. So if you are also an executor or administrator, you will require probate to get the legal authority to deal with their estate.

Therefore, power of attorney does not influence whether or not probate is needed. Instead, the probate requirement depends on what assets the deceased owned and whether the assets were in their sole name.

How Does a Will Work After Death UK?

After someone dies in the UK, their will determines how their assets are distributed through a legal process called probate. This involves identifying assets, settling debts, and distributing the estate according to the will or intestacy laws if there’s no will.

What Happens During Probate?

During probate, the court verifies a will’s validity, settles debts, and distributes assets to beneficiaries according to the deceased’s wishes. This legal process ensures smooth transfer of property and resolves any disputes among heirs.

Summarising ‘What is Probate’

To summarise, probate is the legal way of transferring the administration of estate assets previously owned by a deceased person. In many situations, you might require probate to prove you have the authority to administer the deceased’s property.

If you have more queries or want to know about Wills and probate, check out Wills and Probate Law – Level 3 course to have a comprehensive understanding of all the legal requirements and ramifications that a will requires.

Further Readings

5 Reasons Why You Should Pursue a Cybersecurity Career

Differentiating Web Design and Web Development

Top 10 Social Media Management Tools for Businesses in 2024

Why is Child Development so Important in Early Years

October 07, 2023

October 07, 2023